Biodiversity Net Gain and Offsets Markets in the UK

At the start of 2018, the UK Government outlined its ambitious 25 Year Environment Plan. The very first action is to embed an ‘environmental net gain’ principle for all future developments, including housing. Reconciling the need to build 300,000 new homes in the UK by the mid-2020s with a goal of creating or restoring 500,000 hectares of wetland, woodland, grassland and coastal habitat requires a new approach. The use of “habitat banking” as part of a market for biodiversity offsets is one such innovative policy tool.

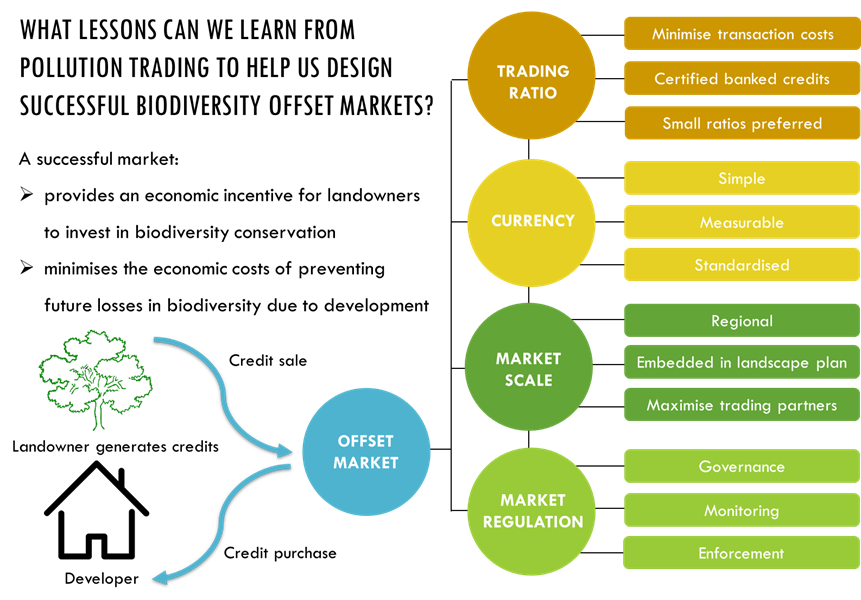

Our work within the Environmental and One Health Group at Glasgow has focussed on providing an environmental economist’s perspective on how we design markets for biodiversity offsets using key lessons from over 50 years of research into pollution permit markets. Our work concentrates on the core question: how can we design successful biodiversity offset markets? By “successful” we mean a market that encourages landowners to invest in biodiversity conservation efforts to meet an ecological goal at a lower cost than alternative policies. We recognise that biodiversity offsetting is controversial. Can it truly deliver No Net Loss of Biodiversity, or a Net Gain in a cost-effective way? We see the most benefit for biodiversity offset markets being in situations where strong biodiversity protection measures do not yet exist and where finding a means to reduce perceived “biodiversity versus development” conflicts will be key to convincing reluctant regulators to implement stricter protection measures.

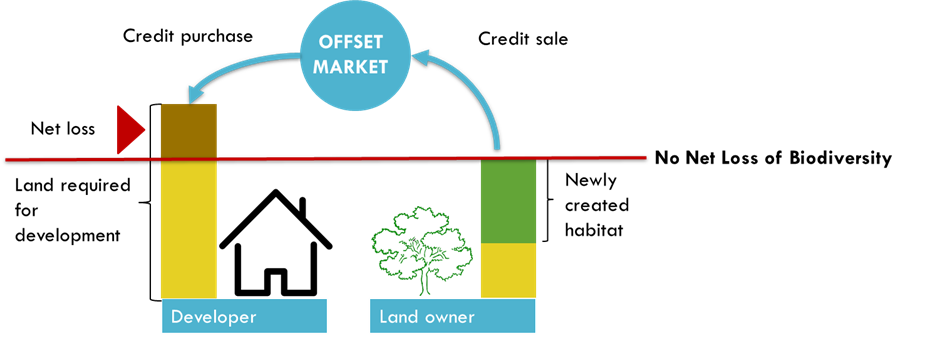

Such an offset market is simple in theory: firms wishing to develop land would need to hold offset credits, which demonstrate the creation of additional conservation gains to compensate for damages caused by development. These credits would be provided by landowners who invest in restoration or protection actions, which earn them a financial return from the sale of credits. Trading in credits creates opportunities for low-cost, effective conservation actions to be funded, lowering development/conservation trade-offs.

Using integrated ecological-economic modelling we have considered several questions related to the design of biodiversity offset markets. The most crucial aspect of the market is what to trade; for emissions trading, this was simple, for example, one tonne of carbon dioxide. For biodiversity, this is much more difficult. We argue that offset markets should only be used where there is a regulatory goal for a specified element of biodiversity, for example, a certain species or habitat. This has significant implications on the other key aspects of market design; the trading ratio which sets the rate of exchange between offsets at different points in space and time; the geographic size of the market; and how the market is regulated.

A summary of our current research papers is provided below. Please contact either Nick Hanley or Katherine Simpson if you are interested in discussing this work further.

Designing markets for biodiversity offsets: Lessons from tradable pollution permits.

Katherine Simpson (Needham), Frans P. de Vries, Paul R. Armsworth and Nick Hanley

We provide a new perspective on biodiversity offset markets by focussing on what can be learnt from one of the best-researched environmental markets: the market for tradable pollution permits. We argue there are four key design parameters in terms of how and what to trade. These design parameters likely determine the ecological effectiveness and economic efficiency of any market in biodiversity offsets.

Needham, K., de Vries, F.P., Armsworth, P.R. and Hanley, N., 2019. Designing markets for biodiversity offsets: Lessons from tradable pollution permits. Journal of Applied Ecology, 56(6), pp.1429-1435.

Incentivising biodiversity net gain with an offset market

Katherine Simpson, Martin Dallmier, Frans P. de Vries, Paul R. Armsworth and Nick Hanley

Most programmes that incentivise the supply of public goods such as biodiversity conservation on private land in Europe are financed through the public purse. However, new ideas for how to fund biodiversity conservation are urgently needed, given recent reviews of the poor state of global biodiversity. In this paper, we investigate the use of private funding for biodiversity conservation through an offset market. The environmental objective is to increase some measure of biodiversity in a region (‘net gain’) despite the loss of land for new housing. Farmers create biodiversity credits by changing their land management and then sell these credits to housing developers who are required to more than offset the impacts of new housing development on a specific indicator of biodiversity. Combining an economic model of market operation with an ecological model linking land management to bird populations, we examine the operation, costs, and biodiversity impacts of such a (hypothetical) market as the target level of net gain is increased. A general result is established for the impacts on price and quantity in the offset market as the net gain target is made more ambitious. For a case-study site in Scotland, we find that as the net gain target is increased, the number of offsets traded in equilibrium falls, as does the market-clearing offset price. Changes in the spatial pattern of gains and losses in our biodiversity index also occur as the net gain target is raised.

Simpson, K., Hanley, N., Armsworth, P., de Vries, F. and Dallimer, M., 2021. Incentivising biodiversity net gain with an offset market. Q Open, 1(1), p.qoab004.

Katherine Simpson, Martin Dallmier, Frans P. de Vries, Paul R. Armsworth and Nick Hanley

Biodiversity offset markets can incentivize private landowners to take actions that benefit biodiversity. A spatially explicit integrated ecological-economic model is developed and employed for a UK region where offset buyers (house developers) and sellers (farmers) interact through trading offset credits. We simulate how changes in the ecological metric and geographic scale affects the performance of the offset market. Results show that the choice of the metric has a significant effect on market liquidity and the spatial distribution of gains and losses in the “target” species. The results also consistently reveal relatively higher potential welfare gains for developers than for farmers.

Simpson, K.H., de Vries, F., Dallimer, M., Armsworth, P.R. and Hanley, N., 2021. Understanding the performance of biodiversity offset markets: evidence from an integrated ecological-economic model. Land Economics, 97(4), pp.836-857.

Ecological and economic implications of alternative metrics in biodiversity offset markets

Katherine Simpson, Martin Dallmier, Frans P. de Vries, Paul R. Armsworth and Nick Hanley

Simpson, K.H., de Vries, F., Dallimer, M., Armsworth, P.R. and Hanley, N., 2022. Ecological and economic implications of alternative metrics in biodiversity offset markets. Conservation Biology.

Policy tools are needed that allow reconciliation of human development pressures with conservation priorities. Biodiversity offsetting can be used to compensate for ecological losses caused by development activities. Landowners can choose to undertake conservation actions, including habitat restoration, to generate biodiversity offsets. Consideration of the incentives facing landowners as potential biodiversity offset providers and developers as potential buyers of credits is critical when considering the ecological and economic landscape-scale outcomes of alternative offset metrics. There is an expectation that landowners will always seek to conserve the least profitable land parcels, and, in turn, this determines the spatial location of biodiversity offset credits. We developed an ecological-economic model to compare the ecological and economic outcomes of offsetting for a habitat-based metric and a species-based metric. We were interested in whether these metrics would adequately capture the indirect benefits of offsetting on species not considered under a no-net-loss policy. We simulated a biodiversity offset market for a case study landscape, linking species distribution modeling and an economic model of landowner choice based on economic returns of the alternative land management options (restore, develop, or maintain existing land use). Neither the habitat nor species metric adequately captured the indirect benefits of offsetting on related habitats or species. The underlying species distributions, layered with the agricultural and development rental values of parcels, resulted in very different landscape outcomes depending on the metric chosen. If policy makers are aiming for the metric to act as an indicator to mitigate impacts on a range of closely related habitats and species, then a simple no-net-loss target is not adequate. Furthermore, to achieve the most ecologically beneficial design of offsets policy, an understanding of the economic decision-making processes of the landowners is needed.

Research Report: An analysis of the empirical evidence on markets for biodiversity offsets

Authors: Katherine Simpson, Nick Hanley and Joseph Bull

Published June 2022

In this review, we focus on the creation of biodiversity offset banks or markets, where a supply of biodiversity credits is generated according to a specific accounting system and related methodology (Ruoso and Plant 2021). This market for biodiversity offset credits is thought to create an economic incentive for conservation. It encourages firms to take costly actions that benefit biodiversity by providing a financial return for their investment in biodiversity conservation (Kangas and Ollikainen 2019).

Within offset policies, we focus in this paper on the evidence base for how technical choices (such as biodiversity metrics, proximity constraints and treatment of ecological equivalence) interact with practical considerations (such as the expected duration of contracts, policy stability, and presence of localised expertise) to affect the outcomes of offset markets and trades. It is known that a perennial problem in the emergence of nascent offset markets has been a shortage in the supply of viable offset receptor sites (for example in England see Baker et al 2014; for Australia see Ruoso and Plant 2021). We consider whether key barriers to incentivising land managers into offsetting lean more towards the theoretical or the practical.

The overarching aim of this paper is to critically review the academic literature on biodiversity offset schemes which reward landowners for protecting and enhancing biodiversity on their land. As such our objectives are:

- to provide a general overview of the design characteristics of biodiversity offset markets;

- to identify the barriers to landowners for creating biodiversity offsets;

- to identify factors that drive participants to buy and sell biodiversity offset credits, and

- identify existing research gaps.

To fulfil these objectives, we found a scoping review approach to be the most relevant method. A scoping review is a systematic literature review approach that seeks to represent, evaluate, and describe the contents of various previous studies to understand the evidence presented while identifying potential knowledge gaps (Arksey and O’Malley 2005).

You can download the final report here: Markets for Biodiversity Offsets (Word)

You can download the Excel document containing the summary of the literature identified in the scoping study here: NERC: Offsets data extraction sheet

This work has been funded by the Natural Environment Research Council: Rewarding landowners and land managers for conserving biodiversity 2022.

Research Report: Farmers, Landowners and Policy Advisor's Perspectives on the Environmental Land Management schemes and markets for biodiversity offsets

This paper has been prepared as part of EFFECT UK Case Study #5 Biodiversity Offsetting to explore farmers, land managers and environmental advisors’ perspectives on various aspects of the Environment Bill and associated 25 Year Environment Plan. We undertook an online survey to assess:

• The strengths and weaknesses of the current AES

• The new AES proposed under the Environment Plan

• Perspectives on biodiversity net gain

• The design and implementation of biodiversity offset markets

Key findings:

- Farmers and advisors see existing AES as offering opportunities for real environmental gains in the agricultural setting but the top-down inflexible approach to delivery limits the potential benefits

- Farmers, land managers and advisors are in broad agreement that the new proposed Environmental Land Management schemes can deliver positive conservation outcomes

- Private-sector funding offers new opportunities to farmers and land managers, especially in the context of habitat banks and biodiversity offsetting

- Obstacles to biodiversity offset market creation focussed on financial risk, lack of information provision and lack of resources

- On-site delivery of compensation hinders the creation of habitat banks

- Advisors felt the current biodiversity net gain target of 10% is too low to deliver the ambitions of the 25 Year Environment Plan

The full report is available to download here: EFFECT Survey Write Up

This work has been funded by:

- Leverhulme Trust Research Project, Grant/ Award Number: Grant RPG-2017-148

- European Union’s Horizon 2020 Research and Innovation programme under grant agreement N°817903.